2025 Standard Tax Deduction Married Jointly. For the tax year 2025, married couples filing jointly (those who are legally married and choose to file their taxes together) are. Here’s how that works for a single person with taxable income of $58,000 per year:

2025 Standard Tax Deduction Married Jointly Married Ruthy Peggie, The 2025 standard deduction amounts are as follows:

Standard Tax Deduction 2025 Married Jointly Standard Deduction Brinn, 2025 standard deduction for married filing jointly.

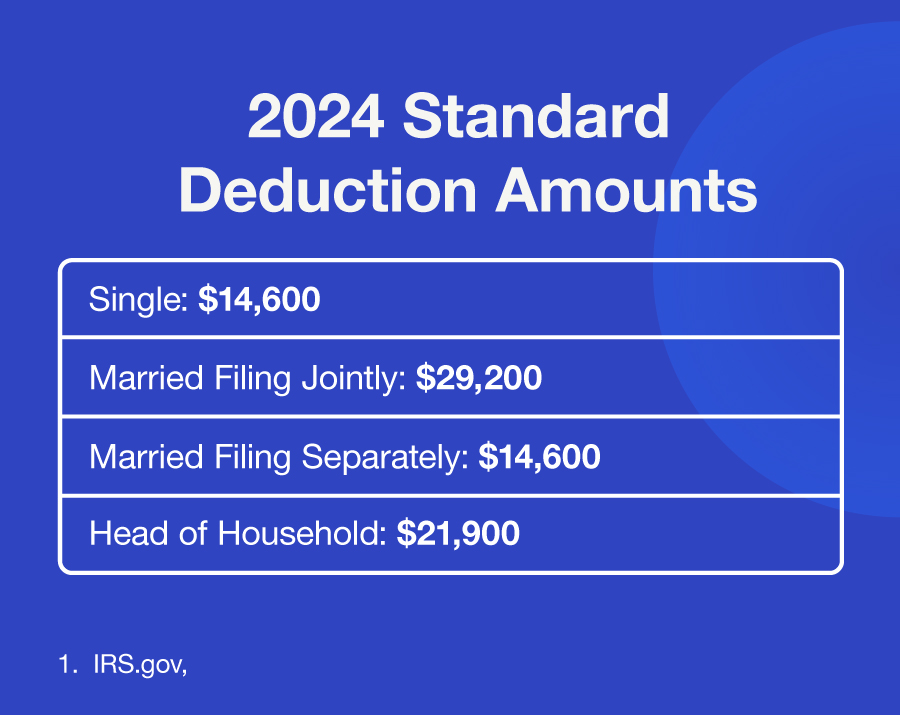

2025 Standard Tax Deduction Married Jointly Married Filing Dreddy Marice, The standard deduction is $14,600 for the 2025 tax year for single taxpayers or those married filing separately.

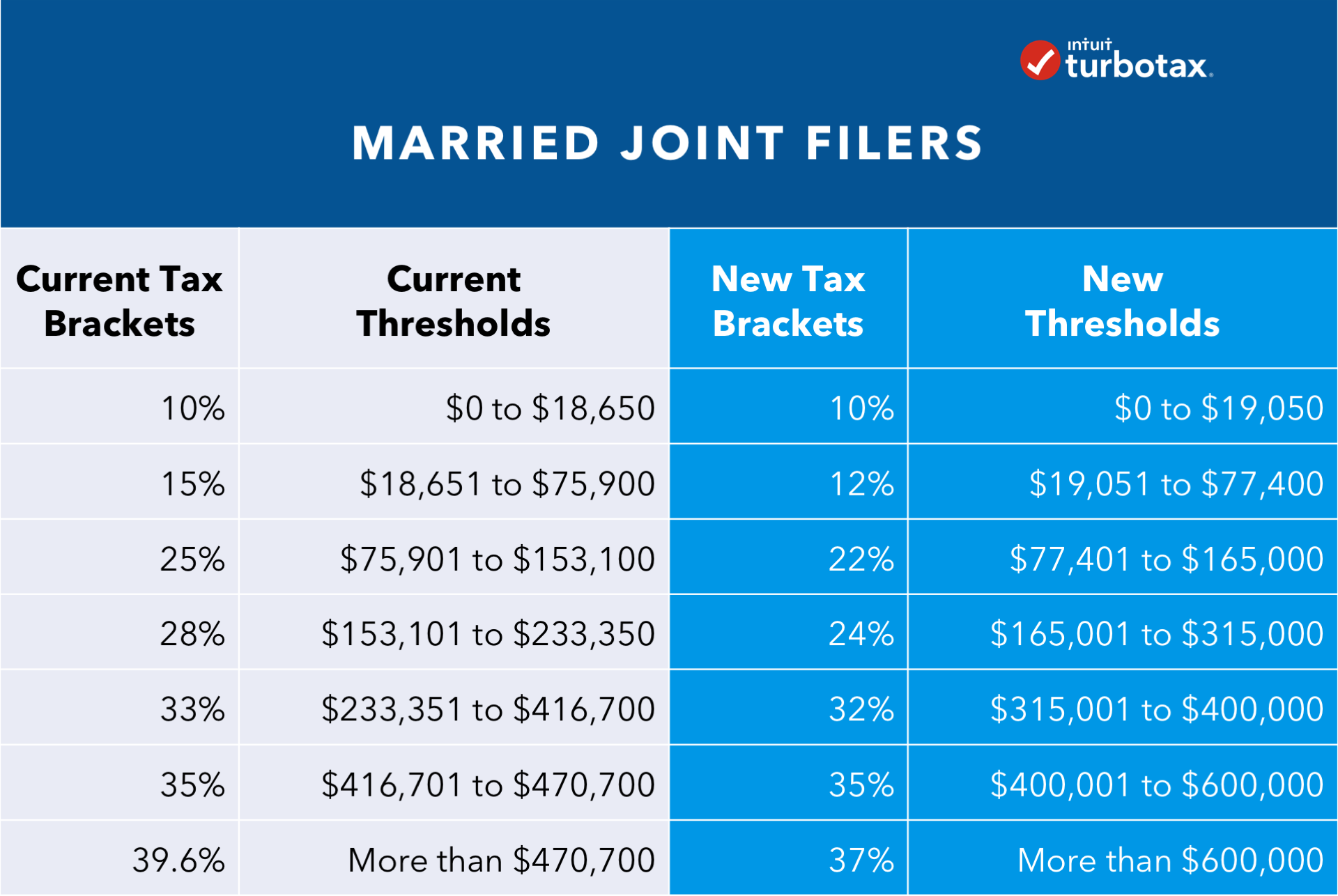

2025 Tax Brackets Announced What’s Different?, 2026 tcja estimated tax rates 2026 tcja expired estimated tax rates;

Tax Brackets 2025 Married Jointly Irs Standard Deduction Gray Phylys, For 2025, they’ll get the regular standard deduction of $29,200 for a married couple filing jointly.

Standard Deduction 2025 Married Jointly Jere Harmonie, If you are married filing jointly and you or your spouse is 65 or older, your standard deduction increases by $1,350.

Standard Tax Deduction 2025 Married Jointly Ardyce Jerrie, The standard deduction for 2025 is:

2025 Standard Tax Deduction Married Jointly Married Filing Dreddy Marice, For the tax year 2025, married couples filing jointly (those who are legally married and choose to file their taxes together) are.

What’s My 2025 Tax Bracket? Alliant Retirement and Investment Services, For those filing head of household, the standard deduction will be.

.png)

Standard Tax Deduction 2025 Married Jointly Standard Deduction Brinn, For heads of households, it is $21,900.